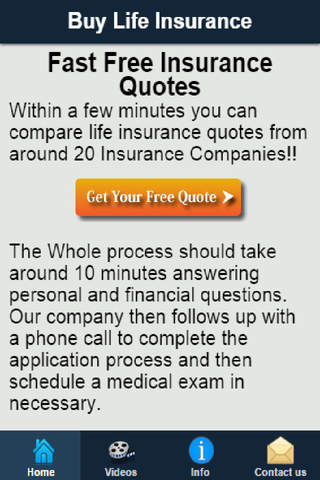

Within a few minutes you can compare insurance quotes from around 20 Companies, and then apply for a policy Online. We DO NOT ASK for Personal Contact information until you decide to purchase a policy.

The Whole process should take around 10 minutes answering your personal and financial questions. Our company then follows up with a phone call to complete the application process and then schedule a medical exam in necessary.

Are you fully covered?

Do you have life insurance? If not, you’re not alone. Thirty percent of U.S. households have no life insurance coverage, leaving them at risk of financial difficulty if a primary breadwinner dies.*

If something were to happen to you, life insurance can help replace your lost income and provide your loved ones with a solid future through additional benefits such as:

Transferring your wealth tax-free to ensure that your assets go to your loved ones – not the IRS.

Preserving your assets by providing funds to help cover estate taxes.

Building cash value (through permanent life insurance policies) that you can access through loans or withdrawals to supplement retirement income, cover emergencies, or help pay for education.

*LIMRA, Ownership of Individual Life Insurance Falls to 50-Year Low, August 2010.

Get the life insurance protection you need.

Buying life insurance doesn’t have to be complicated. There are plenty of great choices – making it easy to find the right coverage for your needs. There are two basic types of life insurance:

Term life insurance provides affordable, basic insurance protection for a specified period of time. It does not build cash value.

Permanent life insurance does not expire, as long as required premium payments are made. It can accumulate cash value based on either a fixed interest rate or variable sub-account performance.

We also have a needs analysis calculator that will help you determine how much life insurance you will need for you and your family. In the event of an untimely death, do you want to have money available to pay for your final expenses, having money for college for your children, paying off a mortgage or debt, replacing your yearly earned income, or providing a Legacy for your family? These all can be handled by a Life Insurance policy.

Call today to learn how life insurance can protect you and your family: (813) 431-2640.